Nairobi, 14 January 2025

The Los Angeles wildfires have dominated global headlines for weeks now.

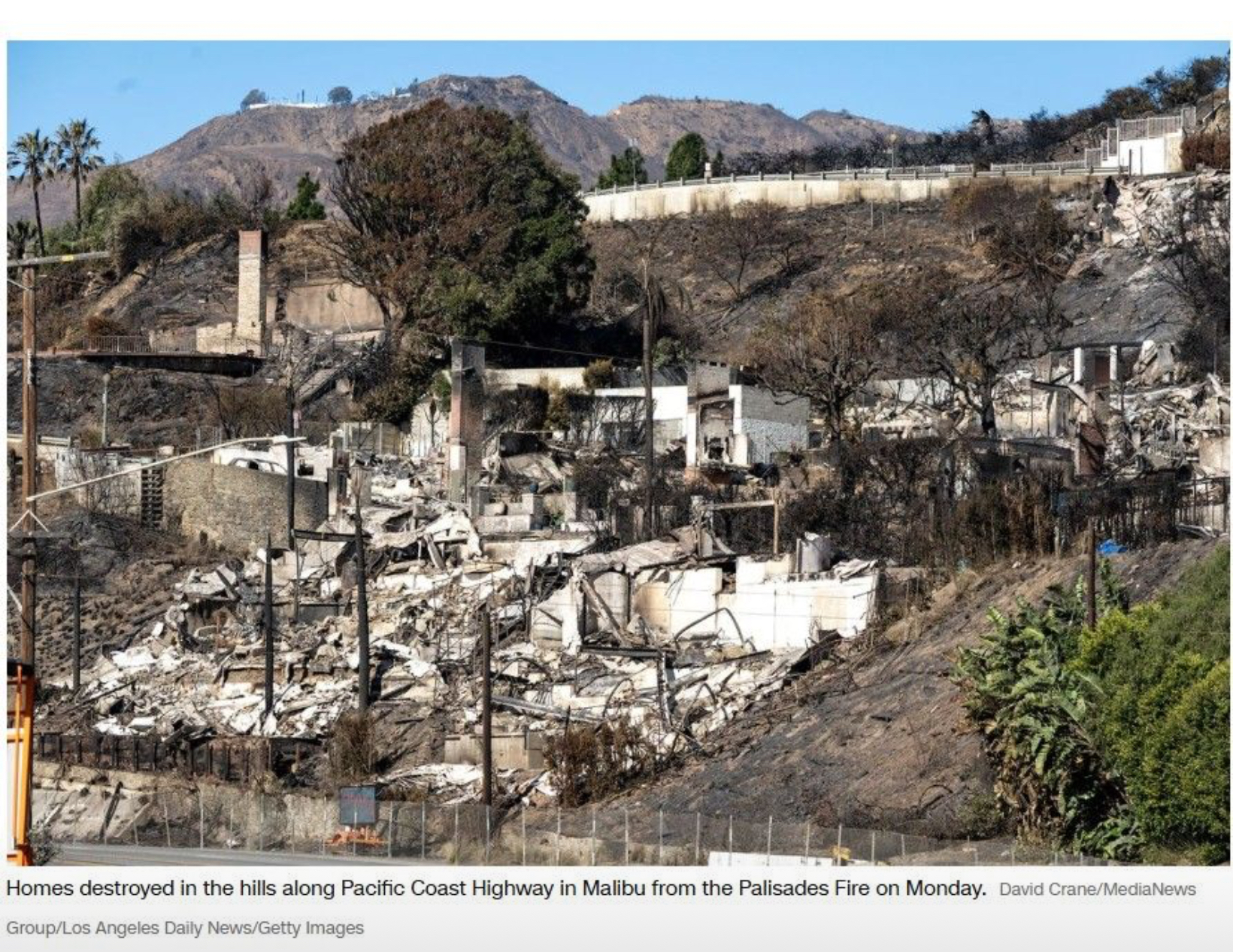

According to the California Department of Forestry and Fire Protection (CAL FIRE), as of 13 January 2025, more than 40,300 acres have burned across multiple blazes — the Palisades, Eaton, and Hurst fires. Over 12,000 homes, businesses, schools, and other structures have been destroyed.

The Pacific Palisades, an affluent residential area with about 9,000 homes, has been among the hardest hit. With a median home value of about USD 3.1 million (ATTOM Data, 2024), this could easily rank among the costliest wildfires in history.

Notably, State Farm, California’s largest home insurer, had already announced plans in 2024 to discontinue 72,000 home and apartment policies, citing growing catastrophe exposure. Other insurers — including All State and USAA — soon followed, leaving many homeowners reliant on the California FAIR Plan, the insurer of last resort that offers basic fire cover when traditional insurers withdraw.

Historic Lessons

Fires of this scale have long shaped the global (re)insurance industry:

-

The Great Fire of London (1666) led to the formation of Lloyd’s of London in the late 1680s.

-

General Cologne Reinsurance Company (1843) was founded after the Hamburg fire.

-

Swiss Re was established in 1863 following the Glarus fire in Switzerland.

It’s no wonder fire is often called “the mother peril.”

Every catastrophic blaze redefines underwriting, claims response, and risk management worldwide.

Looking Ahead

As loss adjusters, surveyors, and claims professionals, these events remind us that preparedness and technical competence are our strongest defenses against catastrophe losses.

They also reinforce the importance of building capacity — ensuring that those handling complex fire and catastrophe claims in Africa are equipped to match global technical standards.

Training & Capacity Building

At Specialty Claims Academy (SCA), we work with insurers, adjusters, and risk professionals to deliver technical training in property, fire, and catastrophe claims management — equipping teams to respond effectively when large losses strike.

If your organization would like to strengthen its team’s fire-loss assessment and reporting skills, we invite you to connect with us.

📧 training@specialtyclaims.co.ke

🌐 www.specialtyclaims.co.ke

Author:

Fredrick A. Oloo

BCom (Ins.), Dip CII, Dip CILA

Lead Trainer & Director – Specialty Claims Academy (SCA)

( Also: Managing Director – Niche Loss Adjusters & Marine Surveyors Ltd

Council Member – Institute of Loss Adjusters & Risk Surveyors (IARS – Kenya)

Committee Member – Chartered Institute of Loss Adjusters (CILA – UK)’s Future Focus Special Interest Group